Don't Leave Your Financial Future to Chance, Plan It

Umarpreet Chawla specializes in wealth transfer and risk management strategies for business owners. Book a free consultation today to protect your assets and ensure peace of mind.

YOUR PARTNER IN FINANCIAL PLANNING

Start Planning Today for a Brighter Tomorrow

MEET THE EXPERT

Umarpreet Chawla

With extensive experience in estate planning and wealth transfer strategies, Umarpreet Chawla is dedicated to helping business owners manage risks and secure their financial future. Our expert services ensure a seamless transition of wealth and provide comprehensive risk management tailored to your unique needs.

Chartered Life Underwriter (CLU)

This certification demonstrates Umarpreet's expertise in life insurance and estate planning, ensuring clients receive top-notch advice for their financial security.

Certified Health Insurance Specialist

Umarpreet's specialization in health insurance allows her to craft comprehensive risk management strategies that protect clients' in difficult times.

Extensive Experience

With years of practical experience in financial planning, Umarpreet has successfully guided clients through estate planning processes, securely managing their legacies and peace of mind.

200+

Families Served

$8.9M+

Worth of Estates Managed

250+

Consultations Provided

99%

Customer Satisfaction Rate

We Specialize in Estate planning

An estate plan is a collection of legal documents and strategies designed to manage and distribute your assets, protect your interests, and achieve specific financial and personal goals, particularly in case of incapacity or death. Here's a breakdown of how an estate plan works and its components

Comprehensive Asset Management

Secure the seamless distribution of your assets by leveraging customized strategies, including wills, trusts, and beneficiary designations, ensuring your legacy is preserved.

Tax Efficiency Planning

Minimize estate taxes and reduce financial burdens on your loved ones by incorporating tax-efficient strategies, such as charitable giving, irrevocable trusts, and lifetime gifting.

Guardianship for Dependents

Protect the future of your minor children or dependents by appointing trusted guardians and creating financial plans to support their well-being.

Healthcare & End-of-Life Decisions

Ensure your medical and personal care preferences are honored with clear directives like living wills and healthcare power of attorney, offering peace of mind during critical times.

OUR SERVICES

Services Included in an Estate Plan

Succession Planning

Secure your business's future with our expert succession planning services, ensuring a smooth journey and business ownership transition.

Retirement Planning

Plan for a comfortable and secure retirement with personalized plans that fit your unique goals and needs. We tailor strategies for your benefit!

Insurance Planning

Safeguard your future with our tailored insurance planning services, designed to protect what matters most. Secure your peace of mind!

RRSP, TFSA, RESP

We help maximize your savings with our financial strategies using RRSP, TFSA, and RESP accounts, helping you achieve your financial goals.

Group Insurance Plans

Protect your employees and business with our customized group insurance plans, offering an extensive variety of coverage and a peace of mind.

Expert Consultation

We assist you in navigating financial challenges and developing plans during our consultation services, ensuring your goals are achievable.

EXPLORE OUR PROCESS

How It Works

Creation

You work with an attorney or financial planner to draft the documents based on your goals and state laws

Asset Titling

In some cases, assets may need to be retitled (e.g., transferring property to a trust)

Implementation

Once the documents are executed, the estate plan takes effect either immediately or upon triggering events like death.

Review & Update

Estate plans should be reviewed periodically or after major life events to ensure they remain relevant.

Execution

Upon death, your trustee ensures your wishes are carried out, often under supervision of a court if probate is involved.

Frequently Asked Questions

What is estate planning and why is it important?

Estate planning involves preparing for the transfer of your assets after your death. It ensures that your wishes are honored and helps minimize taxes and legal complications for your heirs. Proper planning provides peace of mind and financial security for your loved ones.

How can wealth transfer strategies benefit my family?

Wealth transfer strategies help ensure a smooth and tax-efficient transfer of your assets to your heirs. They can protect your family's financial future and preserve your legacy. By planning ahead, you can avoid potential disputes and financial burdens.

What is risk management in estate planning?

Risk management involves identifying and mitigating potential financial risks that could affect your estate. This includes strategies like insurance, diversification, and contingency planning. Effective risk management safeguards your assets and ensures stability for your beneficiaries.

Why should I consider professional estate planning services?

Professional estate planning services provide expert guidance tailored to your unique situation. They help you navigate complex legal and financial landscapes, ensuring your plan is comprehensive and effective. A professional can also keep your plan updated with changing laws and personal circumstances.

How often should I review my estate plan?

It's recommended to review your estate plan every 3-5 years or after major life events, such as marriage, divorce, the birth of a child, or significant financial changes. Regular reviews ensure your plan remains relevant and aligned with your current wishes. Keeping your plan updated avoids potential complications and ensures your goals are met.

WHAT OUR CLIENTS HAVE TO SAY

Client Testimonials

"Working with Umarpreet has been a game-changer for our family's financial planning. She took the time to understand our needs and created a plan that really works for us. We feel so much more secure now. Highly recommend!"

Richard K.

Realtor

"Umarpreet is amazing! She explained everything in a way that was easy to understand and was always available to answer our questions. We never felt rushed or pressured. Honestly, we couldn't be happier with her services."

Rachel H.

Restaurant Owner

Take control of your financial future today.

Schedule your free consultation now and start planning for a secure tomorrow. Click the button down below to book a time slot with Umarpreet Chawla.

Get In Touch

Email:

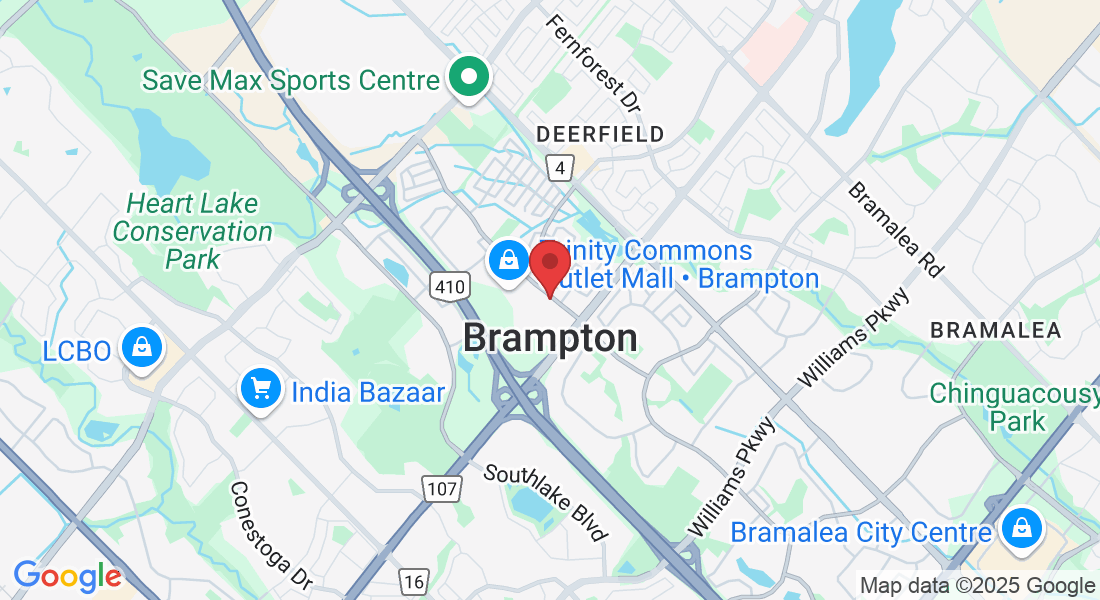

Address:

coming soon

Assistance Hours:

Mon – Sat 9:00am – 5:00pm

Sunday – CLOSED

Phone Number:

+1 (647) 446-1616

Follow Us

Privacy Policy

Terms & Conditions